Investing in digital currency calls for top-notch security, and hunting for the safest crypto exchanges with cold storage is smart trading. Here, you’ll learn how to trust your coins to exchanges that actually guard them against online thieves. You’ll navigate the icy waters of cold storage and why it’s a fortress against cyber heists. I’ll guide you through the maze of technical jargon and into the vault of security features that matter. Let’s march confidently past the pitfalls and find exchanges that marry tough security with icy cold storage solutions. Dive into the how-to of teaming up hardware wallets with your trading spots. You won’t just trade; you’ll trade with the might of Fort Knox. This is your ultimate blueprint to the safest harbor in the crypto storm.

Understanding the Importance of Cold Storage for Crypto Security

Defining Cold Storage in Cryptocurrency

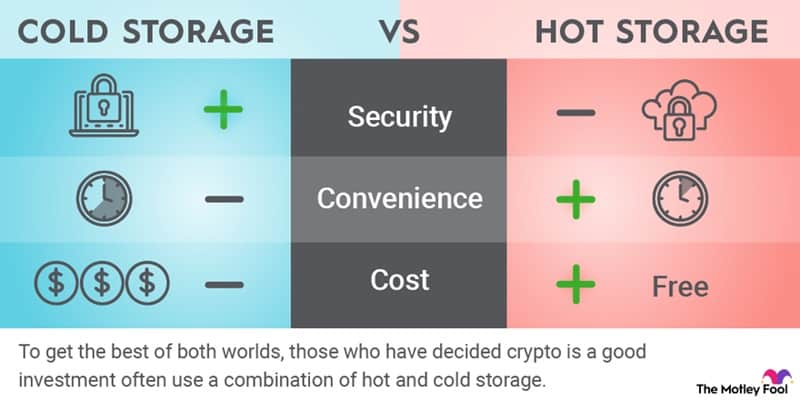

Ever ask what cold storage in crypto is? Let’s dive in. It’s keeping your crypto offline. Off the grid, you might say. It means hackers can’t reach it. Just like your money is safer in a bank vault, your crypto is safer here. These vaults are often physical devices or secure offline places.

Cold storage is key in the crypto world. Your digital coins need strong safes. For real peace of mind, going offline is your best shot. No net, no hack. Simple, right?

The Role of Cold Storage in Preventing Cyber Theft

Now, why’s cold storage a big deal for keeping coins safe? It’s simple. Online wallets can be targets for thieves. But cold storage? It’s like a fortress. Imagine a treasure chest buried on a desert island—no pirates can reach it. That chest is your cold storage.

With cold storage, you can trade with a calm mind. You know those stories of people waking up to drained accounts? With the right cold storage, that won’t be you. It locks away your crypto in a secure place. It’s not just for pros. Everyone who cares about their hard-earned money does it.

Using cold storage can cut the risk of losing your crypto to a sneaky cyber-attack. Think about it. If someone wants to steal your online data, they have to get past layers of security first. It’s like trying to break into a high-tech fortress without the code. Talk about a tough job!

It’s important to pick the safetest cryptocurrency platforms. They’re the ones who care as much about your security as you do. Look for those with strong crypto cold storage features. Those are your best bet for peace of mind.

Remember, not all vaults are built the same. When you’re checking out exchanges, think about their cold storage solutions in crypto. You want solid, tested, and trusted vaults. The leading secure crypto services offer these. They are like the cops of the crypto world. They keep thieves out and your digital treasure safe.

But, how do they do that? By using multi-signature protection. This means more than one key is needed to open the vault. It’s not a one-person job. This makes it even harder for hackers to touch your coins. And that’s what you want, right?

And let’s not forget insurance policies of crypto exchanges. If something goes wrong, are you covered? The best cold wallet exchanges think so. They plan for the worst so you can hope for the best. That kind of thinking keeps you in the game, even when things look bad.

Now you know a bit more about how cold storage keeps your crypto safe. It’s all about staying offline, using strong vaults, and picking the right exchanges. When you do that, you trade with a smile, not a sweat.

Comparing Top-Tier Security Features of Crypto Exchanges

Multi-Signature Protocols and Their Necessity

Let’s talk locks, but for your crypto. Like in a bank vault, you need the top security. With digital cash, this means multi-signature protection. It’s like needing two or more keys to open a lock. A thief can’t do much with just one key.

Multi-signature is a must. It has you team up with others to approve each move of your money. Think of it as a vote among trusted folks, each holding a key, before cash moves. It dodges the risk of one person losing or stealing your stash. This is why the best cold wallet exchanges and trusted altcoin exchanges swear by it.

Assessing Exchange Safety Ratings and Audit Results

Safety first, my friends—also when we trade online. A secure digital currency exchange isn’t shy. It shows its safety score and audit proofs. A high-security bitcoin platform or any leading secure crypto service will have safety ratings and audits easy to find and understand. This transparency means they mean business in keeping your valuables safe.

Do they have top-tier security crypto exchanges ratings? Look into this and ask, “Is my crypto asset protection solid here?” These scores come from tough checks on how the exchange keeps coins away from troubles like hacking. It tells us if our coins are in a good place.

So, when you think of cold storage trading platforms, know that the audits are key. They give the thumbs-up or thumbs-down on whether your cash is safe. Always read user reviews of crypto security too. They are the real talks from those who have been there. This helps you choose not just any platform, but a trusted cold storage service with top-notch locks on your digital wealth.

Selecting the Safest Crypto Exchanges with Cold Storage Solutions

Integration of Hardware Wallets with Exchange Platforms

When we talk about safe trading, we can’t skip hardware wallets. They are physical devices that keep your crypto offline. Many top-tier security crypto exchanges now work with these wallets. This link gives more power to you. It lets you move crypto to and from the exchange with ease. Your assets stay safe even if the exchange has issues.

What are hardware wallet integration benefits in secure digital currency exchanges? They stop hackers from getting your coins. Since hardware wallets store keys offline, they are tough for thieves to reach. When you use them with exchanges, you bring in an extra layer of security. Think of it like a bank vault for your digital cash.

Hardware wallets are key in cold storage solutions in crypto. They use special tech to secure coins. They need your okay for each transaction. This means better safety for your stash. Trusted altcoin exchanges know this. They make sure to offer ways for you to use hardware wallets with their systems.

Insurance and Regulatory Compliance in Crypto Exchanges

Moving on, let’s chat about insurance and rules for crypto exchanges. The safest cryptocurrency platforms have these. They show the exchange cares for your assets. For example, insurance can help if things go wrong, like a hack or system failure.

What does exchange insurance cover? It may protect against crimes, tech issues, and operational mistakes. Each policy differs. So, you should always check what you get with each platform.

Regulatory compliance means the exchange follows laws. It must meet set standards. This includes how they treat your funds, deal with your data, and protect all assets. High-security bitcoin platforms and other crypto services will have this.

Look for audit reports on exchange security. They give insight into the platform’s safety. They tell if it has the right security in place. It also shows if they keep to best practices for crypto storage. Reputable blockchain exchanges get these audits done often. They want to show they are lawful and safe.

It’s smart to use exchange cold storage security with insurance and rule-following. They help ensure that your coins are safe. They give you peace of mind. After all, you don’t want to worry about your digital cash.

Picking a platform needs careful thought. You want top security and good practices. Look for cold storage trading platforms with hardware wallet links. Check their insurance details. And, make sure they follow all needed rules. This way, you can trade with less stress about your coins’ safety.

Best Practices and User Measures for Ensured Safety in Crypto Trading

The Importance of Two-Factor Authentication and Secure Transaction Protocols

When using crypto, think of your coins like cash in your wallet. You wouldn’t leave your wallet just lying around, right? Keep your digital cash safe! It’s key to use two-factor authentication (2FA). What is 2FA? This adds an extra step to confirm it’s really you when you log in or do a transaction. It’s like a double lock on your account. Secure transaction protocols are a must! They make sure that your trade is safe and that your coins end up where they should.

Two-factor authentication for crypto is a game changer. Once you plug it in, you’re not just trusting a password. You now have another layer, something that’s yours alone, like a code from your phone. It keeps your account locked up tight. Even if a hacker gets your password, without the second key, they’re out of luck.

Not all safety steps are up to the site, though. You play a big part, too. Always log out when you’re done trading. It’s simple but super important. Also, make sure your device is free from viruses. A hacked device means trouble for your crypto, even with the best locks. Lastly, keep your passwords and codes secret. Never share them, not even with friends.

Leveraging User Reviews and Community Feedback for Exchange Credibility

User reviews and what people say matter a lot. The best cold wallet exchanges are likely the ones people talk up. Before you trust a platform with your crypto, check out what others have said. A trusted altcoin exchange or a high-security bitcoin platform usually has lots of happy users. When people have good things to say, it’s a good sign.

Community feedback can also alert you to red flags. If you spot repeated complaints about an exchange, pay attention. This means something might be off. It’s better to be cautious. Look for patterns in reviews. Do people say customer service is great? Is it easy to use? These things count when picking a place to trade.

Also, see how the exchange responds to the feedback. Do they fix issues fast? Do they listen to what their users want? This shows they care and work to be one of the leading secure crypto services.

In this digital coin world, your smarts are your best tool! Always tap into the power of community wisdom. It’s like checking the safety rating of a car before you buy. By listening to the crowd and following best practices, you can trade knowing you’ve done your part to guard your crypto treasures.

In this post, we dug deep into keeping your crypto safe. We started by explaining cold storage and how it stops hackers. Remember, cold storage keeps your digital coins offline, away from online thieves.

We then looked at how top exchanges protect your crypto. Things like multi-signature methods are key. Good exchanges also have strong safety scores and audit reports. These details matter.

Next, we talked about picking exchanges that use cold storage. The best ones work with hardware wallets and follow strict rules. They also have insurance—just in case.

Lastly, we covered what you can do to keep your crypto trades secure. Always use two-factor authentication and follow the safest steps for trading. Don’t forget to check out what others say about exchanges, too.

By taking these steps, you can trade with more peace of mind knowing your crypto is in a safe spot. Stay secure out there!

Q&A :

What are the top-rated crypto exchanges that offer cold storage security?

When selecting a cryptocurrency exchange, security is paramount for most users. Exchanges that offer cold storage provide an additional layer of security by storing a significant portion of digital assets offline, thus safeguarding them from online hacks. Among the top-rated crypto exchanges known for using cold storage are Coinbase, Binance, and Kraken. These platforms have established a reputation for their robust security measures, including cold storage practices which help ensure the safety of their users’ funds.

How does cold storage enhance the safety of crypto exchanges?

Cold storage refers to keeping a reserve of cryptocurrencies offline—beyond the reach of online cyber threats. By transferring the majority of assets into cold storage, crypto exchanges significantly minimize the risk of theft from cyber attacks, unauthorized access, and other vulnerabilities that are inherent to Internet-connected wallets. This method is akin to a digital vault, where the private keys necessary for accessing the coins are kept offline, providing an added layer of security for users’ investments.

Are there any crypto exchanges that insure assets in cold storage?

Yes, some cryptocurrency exchanges that use cold storage also offer insurance policies to protect users’ assets. This insurance typically covers a range of potential losses, including those arising from security breaches, employee theft, or fraudulent transfers. For example, Coinbase maintains an insurance policy that covers crypto stored in their hot wallets and has the vast majority of users’ funds in cold storage, providing peace of mind and added security for their customers.

What should traders consider when choosing a safe crypto exchange with cold storage?

Traders should look for several key factors when selecting a safe crypto exchange with cold storage. These include the exchange’s security track record, the proportion of assets held in cold storage, the strength of their end-to-end security practices, and whether they have insurance policies to cover potential losses. Additionally, it is important to assess the transparency of the exchange’s security protocols, the ease of use for withdrawals and deposits, and the quality of customer support in case of any issues.

Can users access their cryptocurrency immediately if it is stored in cold storage?

Cryptocurrencies stored in cold storage are not immediately accessible as they are offline, which is precisely what provides the additional security. However, reputable exchanges have developed systems to ensure that when a user initiates a withdrawal, the funds can be transferred from cold storage to a hot wallet and then to the user in a timely manner. While this might not be as instant as withdrawals from exclusively online wallets, it still allows for relatively swift access while maintaining high security standards.