What is Deriv Bot? Discover the automated trading platform that enables users to create custom bots without coding. Ideal for both beginners and experienced traders, Deriv Bot enhances your trading strategies and market engagement.

What is Deriv Bot?

Deriv Bot, a revolutionary trading platform designed for the crypto market, is shaking things up in the world of automated trading. It caters to both seasoned investors seeking to refine their strategies and newcomers looking for a simple way to navigate the complexities of crypto trading.

At its core, Deriv Bot is a powerful tool that enables users to create and deploy their own custom trading bots. These bots act as automated traders, meticulously executing pre-programmed strategies, taking the emotion and subjectivity out of trading decisions.

Users can set specific parameters like entry and exit points, stop-loss orders, and take-profit targets, allowing the bot to make trades autonomously based on predefined rules.

What is Deriv Bot?

This automation eliminates the need for constant monitoring, freeing up users to focus on other aspects of their lives. The bot diligently executes trades 24/7, even during market fluctuations or while the user is away. This consistent execution ensures that users don’t miss out on potential trading opportunities, a crucial factor in the volatile crypto market.

But Deriv Bot isn’t just about automation. It also empowers users with the ability to control their trading strategies. The platform offers a user-friendly interface, allowing individuals to fine-tune the bot’s behavior to their specific preferences. This level of customization sets Deriv Bot apart from other automated trading solutions, giving users granular control over their trading strategy and allowing them to tailor it to their individual risk tolerance and investment goals.

No Coding, No Problem: How Deriv Bot Makes Crypto Accessible

One of the most significant barriers to entry in automated trading is often the need for extensive coding knowledge. This can be daunting for those without a technical background, effectively excluding a large segment of potential investors.

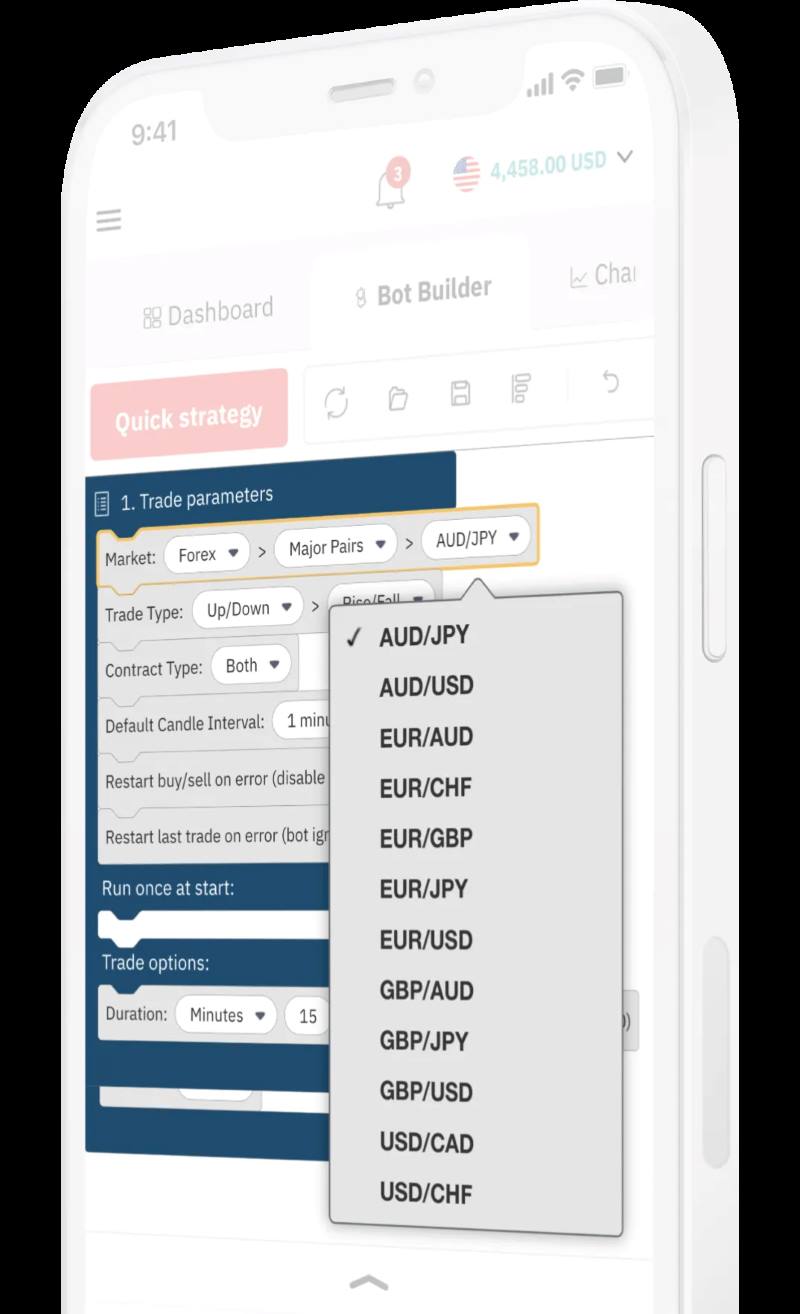

Deriv Bot elegantly circumvents this hurdle by offering a code-free experience. Its intuitive platform features a drag-and-drop interface, enabling users to create and deploy their custom bots without writing a single line of code.

This eliminates the technical complexities associated with traditional bot development, making automated trading accessible to a wider audience.

Even individuals with no prior experience in coding can easily create and customize their own trading bots using Deriv Bot’s intuitive platform. This user-friendly approach fosters inclusivity, welcoming newcomers to the world of automated trading and empowering them to take control of their crypto investments

Advantages of Deriv Bot vs. the Competition

Deriv Bot distinguishes itself in the crowded landscape of automated trading platforms by offering a unique blend of features, accessibility, and flexibility. It stands out in the competition by offering various key advantages:

Pre-Built Strategies: Deriv Bot provides six preconfigured trading strategies specifically designed for the crypto market. These strategies, including popular options like Martingale, Fibonacci, and Grid, can be implemented with a few clicks, allowing users to get started quickly without needing to delve into complex coding or strategy development.

Custom Bot Building: While pre-built strategies offer a convenient starting point, Deriv Bot truly shines in its ability to empower users to build their own custom bots. This customization allows users to leverage their own trading expertise and insights, tailoring bot behavior to specific market conditions or individual trading styles.

Multi-Asset Support: Deriv Bot breaks down the silos of traditional trading by allowing users to trade a wide range of assets, including cryptocurrencies, forex, and commodities. This comprehensive coverage allows users to diversify their portfolios and implement strategies across various asset classes, maximizing their investment opportunities.

Multi-Exchange Compatibility: Deriv Bot transcends the limitations of single-exchange trading by offering compatibility with multiple popular exchanges, including Binance, Coinbase, and Kraken. This flexibility allows users to seamlessly access the liquidity and trading options across various exchanges, enhancing diversification and potentially maximizing trading opportunities.

Low Trading Fees: Deriv Bot minimizes the impact of trading costs with its low fees, only charging a modest 0.05% per trade. This fee structure ensures that users can retain a significant portion of their trading profits, enhancing the overall profitability of their trading strategies.

Six Built-in Trading Strategies of Deriv Bot

Deriv Bot is designed to cater to a wide range of trading styles, offering six pre-built strategies that encompass popular and sophisticated approaches. These strategies provide a solid foundation for both novice and experienced traders, offering a convenient starting point without the need to delve into code.

One of the most well-known strategies, Martingale, is a popular choice for its simplicity and potential to recover losses. It involves doubling your investment after each losing trade in an attempt to recoup losses quickly. While it holds an appeal for aggressive traders, it’s important to understand the associated risks and potential for significant losses if a string of consecutive losses occurs.

Another popular strategy is Fibonacci, which leverages the Fibonacci sequence to identify potential support and resistance levels. This strategy, often used in technical analysis, aims to capitalize on price reversals.

For those seeking a more structured and controlled approach, Grid Trading, which entails placing a series of buy and sell orders at set intervals, presents a compelling option. This strategy thrives in volatile markets, allowing traders to capitalize on price fluctuations and potentially generate profits.

Beyond these three, Deriv Bot offers three additional built-in strategies, each designed for specific market conditions and trading goals. This diverse selection ensures traders have the flexibility to adapt to dynamic market environments.

Building Your Own Trading Bot

While pre-built strategies offer a convenient starting point, Deriv Bot’s true power lies in its ability to create customized trading bots. With the platform’s drag-and-drop interface, users can easily assemble their own trading strategies, tailoring them to their unique insights and market preferences.

This level of customization empowers traders to go beyond pre-defined parameters and develop strategies that align perfectly with their individual trading styles. Whether it’s incorporating specific indicators, technical analysis patterns, or market sentiment data, Deriv Bot equips users with the tools to build bots that reflect their informed and nuanced approach to trading.

The platform further enhances its user-friendliness by offering detailed documentation and tutorials to guide users through the process of creating their own trading bots. This comprehensive support ensures even those new to automation can confidently harness the power of algorithmic trading.

Supported Assets and Exchanges on Deriv Bot

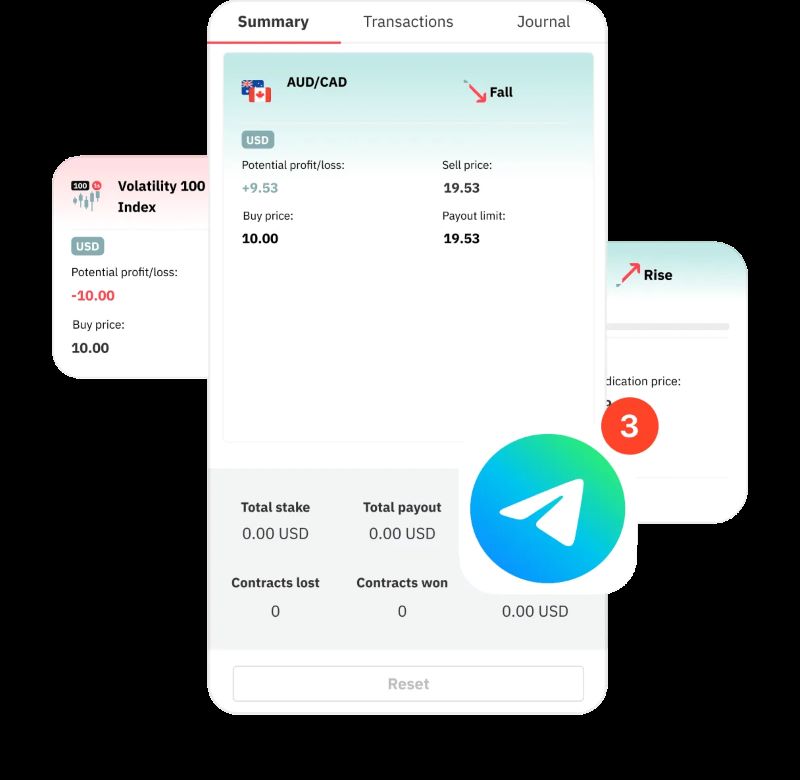

Deriv Bot doesn’t limit its functionality to just Bitcoin. Users can leverage the platform’s capabilities across a diverse range of assets, including other popular cryptocurrencies, foreign exchange pairs, and commodities. This versatility allows traders to diversify their portfolios and capitalize on opportunities across different markets.

The platform further extends its reach by supporting multiple exchanges, including Binance, Coinbase, and Kraken, giving traders the flexibility to access their preferred trading venues. This compatibility ensures traders can utilize Deriv Bot within their existing trading ecosystems without having to navigate complex account transfers or adjust their trading practices.

With its vast asset coverage and diverse exchange support, Deriv Bot empowers traders to maximize their trading potential, opening doors to new opportunities and expanding their exploration of the financial markets.

Visit Dynamic Crypto Network to learn more about this groundbreaking platform and start your automated trading journey today