Exploring Liquid Staking in Crypto, you’re in for a treat! It’s the new way to earn without locking up your coins. Here, we’ll dive into how it flips the script on old-school staking. Say goodbye to waiting for rewards and hello to cash flow. You’ll learn the nuts and bolts of liquid staking, then weigh the pros and cons. Get ready—we’re about to map out how liquid staking can pump up your crypto strategy!

Understanding Liquid Staking and its Mechanisms

What is Liquid Staking and How Does it Differ from Traditional Staking?

Have you ever heard of liquid staking? It’s staking crypto, but better. In traditional staking, your coins can’t move. They’re stuck till the staking period ends. Liquid staking frees them up. This means you stake your coins and yet, you can still use them for other things in DeFi liquid staking. It’s like earning interest on your savings account while still spending your cash.

Let’s dig in. When you stake normally, you get rewards. But your coins are untouchable, locked away. With liquid staking, you stake, earn rewards, and get a special token. This token represents your staked coins. Now you can trade it, use it as a loan collateral, or stake it again. Another round of earnings? Sounds good!

But don’t forget, not all staking is the same. Some give out more rewards, some less. Picking the right staking pool platforms and best liquid staking platforms is key. Also, choosing tokens wisely is a big deal. Some coins, like those built on Ethereum 2.0 staking or BEP-20 tokens staking, might offer more bang for your buck.

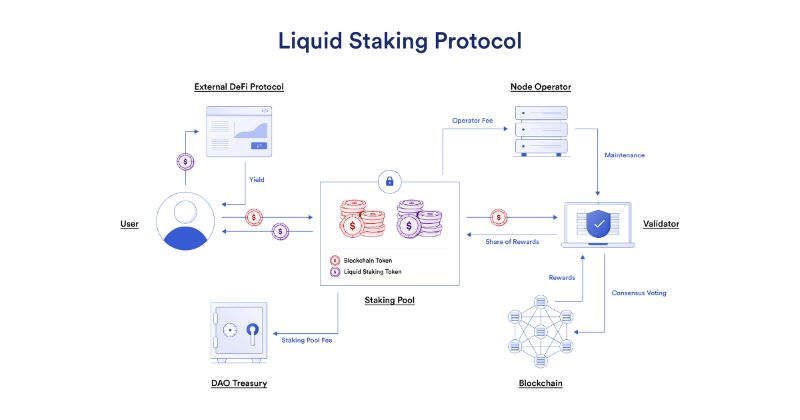

A Deep Dive into the Key Components of Liquid Staking Protocols

Ready for a closer look? Imagine a machine with gears. Each part is vital. Liquid staking protocols work similarly, with key parts playing crucial roles.

Validator Nodes in Staking: These are like the engine. They process transactions and keep the network secure. Staking on these nodes offers you a slice of the rewards pie. But remember, you want to work with the best. A reliable node means a happy wallet.

Staking Pool Platforms: Think of these as gathering spots. Here, lots of people come together, adding their coins to a big pot. This pool stakes on the network to earn returns. And everyone gets a cut, based on their share.

Staking Rewards: The sweet fruit of your patience! By having your coins staked, you earn more coins as rewards. More staking means more rewards – simple, right? But, beware of staking digital assets in risky spots! Always aim for secure staking practices.

Staking Liquidity Solutions: Got your tokens tied up? These solutions let you move them around. Use them, spend them, earn more. It’s about making your staked assets work harder for you.

Cross-Chain Liquid Staking: Here comes the cool part. Got staking on Ethereum and want to try somewhere else too? Cross-chain lets you mix and match, staking across different networks. It’s your ticket to a wide world of staking opportunities.

So, buckle up! Liquid staking is changing the game. It’s not just staking your cash. It’s making your staked coins dance for you, earning rewards across DeFi, non-stop. And as your go-to guide, I’m here keeping you on the smart path to max out those crypto earnings. Ready to dive in? Let’s stake those coins and watch them grow!

The Benefits and Risks of Liquid Staking

Exploring the Advantages of Liquid Staking for Yield Generation

Liquid staking lets you make money from your crypto without locking it up. You stake coins and get new tokens you can use right away. It’s like putting money in the bank, but you still get to spend it. This feels great because you’re earning without stopping your coins from being used in other ways.

Think of liquid staking protocols as helpful friends. They let you earn extra by doing smart moves with your coins. With DeFi liquid staking, these friends are super smart, always looking for the best deals in the crypto world for you.

Yield generating strategies in liquid staking can lead to passive income. It’s a sweet deal. Just hold some coins and watch as more coins come your way.

Staking rewards really add up over time. You put your crypto in a staking pool platform, and voila, more crypto comes back to you. It’s simple, with Ethereum 2.0 staking opening doors to even more earnings.

Now, let’s chat about liquid staking vs traditional staking. Liquid means you can still trade your staked coins. Traditional staking locks them up for some time. Imagine wanting ice cream but your money’s in a piggy bank you can’t open yet. Liquid staking gives you the key to the piggy bank whenever you want.

So, how liquid staking works? You join a staking-as-a-service provider or a staking pool, and they handle the techy bits, like validator nodes in staking. Even better, you can jump between chains with cross-chain liquid staking. It’s like having a passport for your coins to travel and earn everywhere.

Identifying and Mitigating Risks in Liquid Staking Investments

Sure, liquid staking is cool, but it’s not all smooth sailing. There are risks. The biggest worry? The value of your staking rewards might drop. That’s the risk with any crypto investment, though. Market swings can be wild.

Another head’s up is to know about unstaking periods in crypto. Some platforms make you wait to get your main coins back. That can be a bummer if you want out fast.

Security is something you can’t ignore. Only use secure staking practices. The secure part means avoiding trouble by picking staking pool platforms that are like fortresses, tough for hackers to break into.

Remember the law, too. Staking and taxation need to walk hand in hand. You should count your staking rewards as income and talk to a tax expert.

Choose non-custodial staking options if you’re all about holding on to your keys. It’s like keeping your house keys with you instead of giving them to a stranger.

Lastly, keep an eye on the staking tokenomics. Know how the staking works inside the coin’s world. This affects how much you can earn.

In short, liquid staking is a powerful way to make your coins work for you. Just weigh the good against the risks. Strap in, do your homework, and you might just enjoy the ride in this fast-moving crypto world.

Integrating Liquid Staking in Your Crypto Portfolio

Strategies for Maximizing Earnings Through Liquid Staking Positions

Staking crypto offers a tidy way to earn more. Think of it like a savings account, but better. Your coins work for you, pulling in extra cash. This is how staking shines.

But wait, let’s level up! Enter liquid staking, a flashy twist on the usual deal. Here, when you stake, you get a token in return. This special token keeps staking while you’re free to use it elsewhere. That’s double the action from your staked coins!

To get the most out of this, be smart about it. Pick solid, well-known liquid staking protocols. Spread your bets. Don’t dump all your eggs in one basket.

And remember, timing matters! If a token is hot, it might be wise to stake it. When it cools down, take a step back. Watch the market. Act when the time is right.

A Comparative Analysis of Liquid Staking vs. Traditional Staking Approaches

Now, some folks stick to old-school staking. Lock coins away, get rewards. It’s simple. Yes, it’s secure. But it ties up your money. Can’t use those coins for anything else.

Here’s where liquid staking struts in. It gives you freedom. Stake coins, get rewards, and keep your coins moving. Use the special tokens for trades or loans. That’s handy, isn’t it?

But, risks lurk around the corner. With new tech comes new troubles. A glitch in the system can cause a world of hurt. So, stay alert.

Big picture? Liquid beats traditional staking for folks who love action. You get that steady staking dough with extra play room.

Choosing between them? Ponder on what fits you. Want it easy and steady? Go traditional. Like a dash of spice and extra gains? Liquid’s your jam.

In short, liven up your earnings with liquid staking. Check the risks, sure. But for true crypto adventurers, it’s a step toward serious earning power.

The Future of Staking in Decentralized Finance

The Role of Ethereum 2.0 and PoS Networks in Advancing Staking Options

Imagine earning money while you sleep. That’s what staking crypto does. It’s a way to earn more coins just by holding them. And with Ethereum 2.0 in the mix, it’s all getting a big upgrade. Ethereum 2.0 is moving from proof of work (PoW) to proof of stake (PoS). This means anyone with Ethereum can help secure the network. In return, they earn more Ethereum.

This change to PoS also makes Ethereum more eco-friendly. It uses less electricity than before. Now, let’s dive a bit deeper. PoS networks rely on validator nodes. Think of them as the pillars that hold up the network. They process transactions and create new blocks. Running a node takes a big computer and a lot of coins. If you don’t have both, don’t worry. You can join a staking pool. This is like a group where everyone puts their coins together.

By doing this, you help make the network safe. And as a thank you, you get a slice of the staking rewards. Not all coins have PoS yet. But many are following Ethereum’s lead. This makes staking a key part of crypto’s future.

Emerging Trends and Innovations in Liquid Staking Platforms

Liquid staking is the next-level move for earning in crypto. How does liquid staking work? First, you stake your coins. But instead of locking them up, you get special tokens back. These tokens show you’ve staked. But here’s the best part: you can use these tokens to do more things. You can trade them or use them as collateral for a loan.

This way, you’re earning and still free to move. More platforms now offer liquid staking. They have different names and slight rule changes. This might sound a bit risky. And, sure, all things in crypto come with risks. Liquid staking risks include smart contract bugs or price drops. That’s why you should do your homework before diving in.

Look for secure staking practices. This includes picking platforms that many trust. Check what others are saying. And always read up on how each platform keeps your investment safe. For those who like to explore, cross-chain liquid staking is here too. It lets you stake on different blockchain networks. It’s like visiting many countries using the same passport.

DeFi liquid staking guides are everywhere online. Find one that’s easy to understand and start your journey. Remember, laws about staking and taxation vary. It’s crucial to know them to avoid trouble later. Good news is that many platforms help with this now.

Staking isn’t new, but the ways to do it are getting better every day. Tools for staking digital assets continue to grow. For those seeking passive income in crypto, this is your time. If you want a staking coins list, many websites offer them. But the best option will fit your goals and risks you can take.

The future shines bright for stakers. Especially if you’re keen on testing new waters with liquid staking. Keep an eye out for more updates. New ways to stake are popping up as crypto grows. And that’s a journey worth being part of.

In this post, we’ve dived into liquid staking and how it’s changing the game for crypto holders. From its basics to its complex parts, we learned it can lead to more cash flow than old staking methods. We also looked at the pros, like getting cash from your staked coins, and the cons, like some extra risks. Then, we talked about adding liquid staking to your crypto mix to try for bigger wins. Finally, we looked ahead at how Ethereum 2.0 might make staking even hotter and checked out cool new trends in the mix. Remember, as with all money moves, be smart and do your homework. Liquid staking might be just the twist your portfolio needs to grow.

Q&A :

What is liquid staking in cryptocurrency?

Liquid staking is an innovative process that allows cryptocurrency holders to stake their assets while still maintaining liquidity. Unlike traditional staking, where assets are locked up for a set period, liquid staking provides users with a tokenized version of their staked assets, which can then be traded or used in various decentralized finance (DeFi) applications. This method aims to enhance asset utility and yield-generation opportunities for stakers.

How does liquid staking differ from regular staking in crypto?

The primary difference between liquid staking and regular staking lies in the liquidity of the staked assets. In regular staking, crypto holders lock their tokens in a wallet to support the operation of a blockchain network, and in return, they earn rewards. However, these tokens cannot be easily accessed or traded until the staking period ends. In contrast, liquid staking allows participants to receive a representative token that they can use or trade, providing greater flexibility and immediate liquidity while still earning staking rewards.

What are the benefits of liquid staking in crypto?

Liquid staking offers numerous benefits including:

- Enhanced Liquidity: By receiving a tradeable token after staking, users can access the value of their staked assets without having to un-stake and potentially miss out on rewards.

- Increased Capital Efficiency: Users can leverage their staked tokens to participate in other DeFi activities, opening up avenues for additional earnings or borrowing.

- Reward Maximization: Liquid staking allows users to compound their rewards by utilizing their staking tokens in different protocols simultaneously.

- Reduction in Risk: With regular staking, there’s a risk of asset value depreciation during the lock-up period. Liquid staking provides a way to mitigate this by enabling users to react to market movements.

Can you lose money by liquid staking in cryptocurrency?

As with all investments, there is a risk of losing money with liquid staking. The value of the tokenized staked assets can fluctuate due to market conditions, and there can be smart contract risks associated with the platforms or protocols facilitating liquid staking. Users should conduct thorough research and consider the risks before engaging in liquid staking.

Which cryptocurrencies currently offer liquid staking solutions?

Several cryptocurrencies and platforms now offer liquid staking solutions. Ethereum’s upgrade to Ethereum 2.0 introduced liquid staking through various DeFi platforms. Other notable projects include Cosmos (ATOM), Polkadot (DOT), and Tezos (XTZ), each providing their own unique liquid staking mechanisms. As the DeFi ecosystem continues to evolve, more cryptocurrencies are likely to adopt liquid staking to provide value to their holders.