Navigating the crypto world takes more than luck; it demands a smart plan for your money. To win big, you need to know your endgame. Setting investment goals and risk tolerance for cryptocurrencies is not just smart; it’s vital. You eye that digital coin dance, wondering, can it build your dream? Or is it a sly fox, ready to dash? Let’s cut through the noise. I’ll show you how to map your crypto route, measure the bumps, and ride them like a pro. Ready to make those coins work for you? Let’s dive in.

Understanding Your Personal Cryptocurrency Investment Goals

Defining Clear Crypto Savings and Investment Objectives

When you start in crypto, have a clear goal. Ask yourself, “What’s my aim?” Do you want quick cash or long-term wealth? Your answer sets your path. Maybe you want to save up for a house or retire early. Keep these goals in mind. They will guide your crypto journey.

Next, think about how much risk you can handle. Not everyone is okay with big ups and downs. If large swings scare you, you might aim for less risky coins. But if you’re cool with risks, you might go for newer or less known coins. Knowing your comfort zone is key.

Also, try to spread out your investments. Don’t put all your eggs in one basket. This way, a drop in one coin won’t sink your whole plan. Try different coins or blockchain projects. It’s smart to find a mix that fits your goals and sleep-well level.

Remember, the crypto world can change fast. Keep learning and stay flexible. Your goals may need tweaks as you go.

Establishing a Cryptocurrency Investment Time Horizon

How long are you in this game? Your time frame matters a lot in crypto. If you’re in for the short sprint, your choices will differ from a marathon runner. Short-term players might trade more and follow price swings closely. Long-term believers often hold onto their coins, even through dips.

For short-term investing, you need to keep an eye out often. It’s like fast-paced chess. Every move counts. Long-term, though, it’s more like planting a tree. You choose a good spot, plant it, and give it time to grow.

Decide if you’re looking for quick results or if you’re okay waiting for your crypto seeds to blossom. Your time horizon affects how you pick coins and how you react to price changes.

Think about when you’ll need the money. Are you saving for something in five years or twenty? This will help you figure out your best moves. It’s about getting your money to work for you within your time frame.

Do you need the cash soon? You might play it safe with bigger, more stable coins. Looking far ahead? Then you might take some well-thought-out risks for possibly bigger rewards.

And remember, no matter your time frame, never invest money you can’t afford to lose. Crypto can be a bumpy ride. Make sure you’re ready for it, both with your heart and your wallet.

As you set your goals and time horizon, your plan starts to take shape. You’ll see which strategies and tools fit you best. Then, you’re on your way to becoming a savvy crypto investor, ready for both the good times and the bad in the ever-exciting world of digital currency.

Assessing Your Risk Tolerance in the Volatile Crypto Market

Methods for Risk Assessment in Crypto Investments

How do you deal with the ups and downs in crypto? First, know your limits. Can you watch your investment drop by 30% and stay calm? If not, you might aim for less risky coins. Starting with a small sum is smart. It helps you learn without losing much.

How do you set your risk level in crypto? Think of your other needs. Do you have enough saved for emergencies? If yes, you can likely take more risk in crypto. If no, it’s best to be careful. Put simply, don’t risk what you can’t afford to lose. Keep most of your money in safe places.

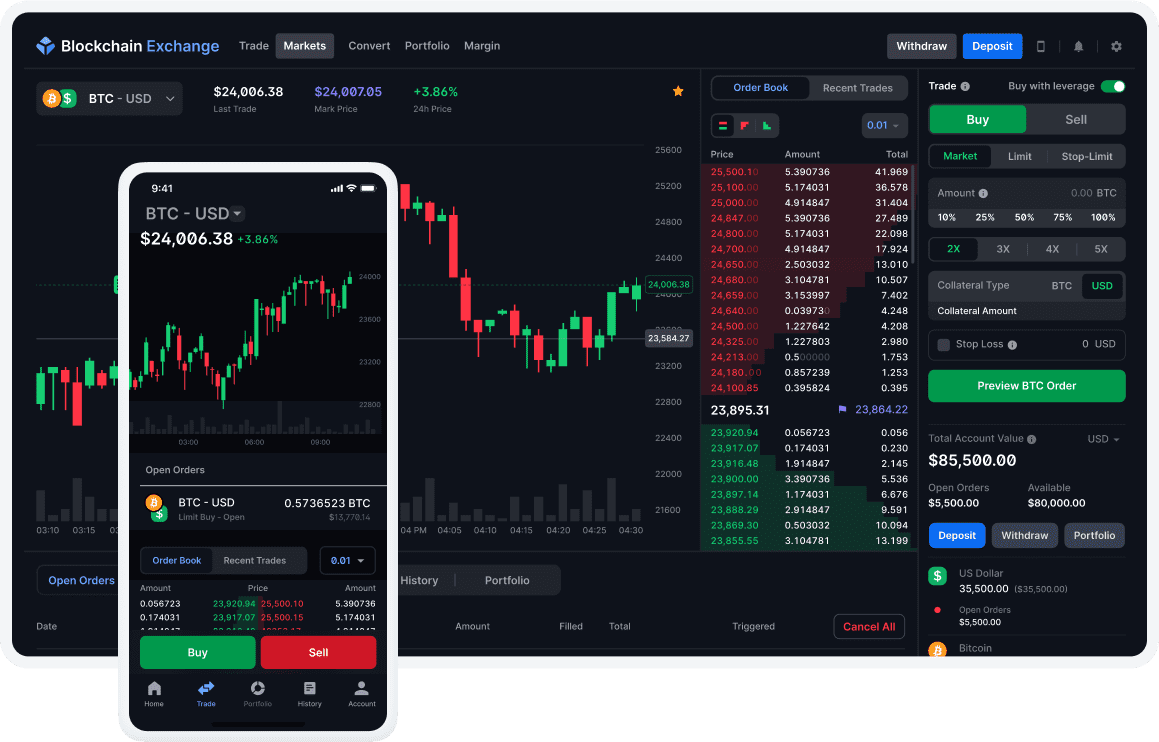

Beginner Crypto Wallet Comparison

How do you find your perfect blend of crypto for your portfolio? It’s about balance. Mix different kinds of crypto. Blend in some with less price swing. Add others for growth. This mix changes with your life. As you get older, adjust for less risk.

How often should you change your crypto mix? Not too often. Look at it once or a few times a year. You want to give your strategy time to work. But if your life changes, or if the market shifts a lot, it can be time for an update.

Crypto investing is a personal journey. What works for one may not work for all. The right balance can help you ride through the market’s wild swings.

Emotional Discipline and Its Role in Managing Crypto Risks

Why is staying calm so hard in crypto? The prices jump around a lot. It’s easy to panic or get too excited. But making choices in those states often leads to bad calls.

How do you keep a level head? Have a plan before you start. Decide when to sell for a gain or a loss. Stick to this plan. When prices move a lot, don’t let fear or greed push you off course.

Why is sticking to a plan so important? The plan is your map. It keeps you on track to your goals. Without it, it’s like wandering with no direction. Plus, having a plan helps you measure success.

Staying cool during stressful times is key. It might mean not checking your crypto every day. Or setting alerts for big price changes. Think of it this way: Emotional discipline in crypto is like staying calm in a storm. It lets you think clearly and make good choices.

Remember, in crypto, ups and downs are normal. Learn to expect them. Plan for them. This way, you can grow your investment smartly, without nasty surprises.

Creating a Tailored Cryptocurrency Investment Strategy

Balancing Short-Term vs Long-Term Crypto Investing Approaches

When you jump into crypto, think: fast gains or big dreams? That’s short-term vs long-term. Short-term might give quick cash. But it’s a wild ride, with sharp ups and downs. Long-term is more chill. We’re talking about holding on tight, even if prices dip. This means trusting your picks for years. So, what’s your play? Quick flips or the long haul?

The Interplay Between Asset Allocation and Diversification in Crypto Assets

Asset allocation sorts your money into different crypto-buckets. Each bucket is a chance to win or lose. Diversify, and you spread risks across more buckets. It’s not about putting all your eggs in one basket. Mix it up with different cryptos. Think Bitcoin, altcoins, even some tokens from fresh projects. This way, if one dives, you’re still set. It’s smart, like not betting your whole wad on one roll of the dice.

Why bother with all this? Simple. Crypto’s a jungle. Prices swing wild. But with a solid plan, you’re the boss. You can take charge and set your own path. Your future self will thank you. Trust me, I’ve been where you are, and planning ahead pays off.

Now, don’t get me wrong – it’s not a cakewalk. But listen, dive deep into understanding crypto market volatility, position sizing in crypto trading, and all that jazz. It’s crucial, really. Keep tabs on blockchain technology risks and the impact of regulation on crypto investments.

And, let’s not forget about ICOs and tokenomics. They’re like the seeds of the crypto world. Some grow into mighty money trees, others, not so much. Figuring out which is which, that’s where the magic happens.

So, you’ll need to tackle some tough questions. What’s your risk appetite? Can you watch your crypto dip without losing sleep? Or are you on edge, ready to sell at the first dip? It’s all about finding your comfort zone.

Let’s break it down. Start by charting out your crypto savings goals and investment time horizon. Be real with yourself. Can you lock funds away and let them grow? Or do you need to cash out sooner?

Setting crypto investment objectives should be your first move. Next up, figure out your risk-reward ratio in cryptocurrencies. It’s all about balancing potential profit against what you could lose.

Remember, knowing when to rebalance your crypto portfolio is key. And yeah, it sounds fancy, but it just means adjusting your buckets to stay on track.

So, here’s the deal: Decide on your crypto risk tolerance levels. Take charge of your digital currency investment planning. Mix short-term plays with long-term holds. Use smart contracts wisely to meet your investment goals.

Investing isn’t about luck; it’s a skill. And with the right strategy, you steer your own ship in the crypto sea. Your course is yours to chart. Get it right, and the rewards are epic. Get it wrong, and well, it’s back to the drawing board.

Take your time. Learn the ropes. In crypto, knowledge is more valuable than gold.

Tools and Techniques for Risk Management in Crypto Portfolios

Setting Profit Targets and Identifying Loss Thresholds

In the crypto world, you must set clear profit goals. How do you do that? Decide on an amount you aim to earn from each trade. This is your profit target. A profit target is a key to locking in gains. It helps you to avoid greed.

What about when things don’t go as planned? That’s where loss thresholds come in. A loss threshold is the most you are willing to lose on a trade. Knowing this sets a boundary. It keeps one bad trade from wiping you out.

To start, look at past trades. What were your gains and losses? This history can guide your future targets and thresholds. Remember, each trade gets its own targets. They should all fit within your broader crypto strategy.

Sticking to these numbers is tough. Emotions can push you to hold on longer. They can also make you sell too soon. Stick to the plan. This discipline will serve you well in the long run.

Utilizing Stop-Loss Orders and Dollar-Cost Averaging Strategies

Stop-loss orders are a must for crypto traders. They are set to sell an asset if its price falls to a certain level. This level is your loss threshold. Using them can help you sleep at night. They keep a bad drop in the market from taking all your money with it.

But what about when the market is bouncing up and down? Here comes dollar-cost averaging (DCA) to the rescue. DCA means putting in the same amount of money on a schedule. It could be weekly or monthly. The key is consistency. This evens out the highs and lows. Over time, this can reduce your overall cost.

Let’s say you choose to invest $50 every month. Some months, prices are high. Others, they’re low. But your average cost will likely even out. You won’t stress over timing the market perfectly. It’s a simple but powerful strategy for long-term investing.

Now, apply these tools in line with your personal financial situation. This means adjusting your methods as your life changes. Maybe you get a raise or face unexpected bills. Keep your investment strategy in sync with your life.

Risk management in crypto doesn’t have to be scary. Use profit targets and loss thresholds. Use stop-loss orders and dollar-cost averaging. Keep learning and adjusting. You’re building a foundation for crypto mastery, trade by trade.

In this post, we tackled key steps to smart crypto investing. We kicked off by setting clear investment goals and mapping out how long you want to invest. Remember, having a plan helps you stay on track. Next, we looked at risk. We’re all different when it comes to how much risk we can handle—know yours and keep emotions in check to make solid choices.

Then, we dived into crafting your unique strategy for crypto. That means weighing quick wins against long-haul gains and mixing up your crypto to spread risk. Lastly, we covered tools for risk management—set those profit goals and cut-off points for losses, and use smart moves like stop-loss orders and averaging your investment costs.

Final thoughts? Crypto’s a ride, but with these pointers, you’re all set to invest with confidence. Stick to your plan, play it smart with risk, and adjust as you learn. Here’s to making your crypto journey a winning one!

Q&A :

How do I set investment goals for cryptocurrency trading?

Setting investment goals for cryptocurrency trading starts with clearly defining what you want to achieve and in what timeframe. Consider whether you’re aiming for short-term gains through active trading or long-term growth by holding. Evaluate the potential return on investment (ROI) based on your time horizon and assess how cryptocurrency fits within your broader investment portfolio. Always align your investment goals with your financial situation and end objectives.

What is risk tolerance, and how do I determine mine for investing in cryptocurrencies?

Risk tolerance is the degree of variability in investment returns that an individual is willing to withstand in their investment portfolio. To determine your risk tolerance for investing in cryptocurrencies, you’ll need to evaluate your financial situation, investment experience, time horizon, and comfort level with volatility. Tools like risk tolerance questionnaires can give you a baseline, but self-reflection on past financial decisions can also offer insights. Cryptocurrencies are known for their high volatility, which should be factored into your assessment.

What strategies can I use to balance risk when investing in cryptocurrencies?

To balance risk when investing in cryptocurrencies, consider diversifying your crypto assets, similar to traditional investment diversification. Invest in a mix of coins and tokens that have different use cases and market capitalization levels. It’s also sensible to allocate only a portion of your portfolio to cryptocurrencies, with the rest in less volatile investments. Regularly revisiting and adjusting your portfolio to align with your investment goals and risk tolerance is key. Employing stop-loss orders can also help manage risk effectively.

How important is understanding the cryptocurrency market for setting investment goals?

Understanding the cryptocurrency market is crucial for setting realistic and informed investment goals. Knowledge of market trends, the technology behind cryptocurrencies, regulatory landscapes, and the economic factors influencing prices can aid in making strategic investment decisions. Additionally, being well-informed helps you to anticipate market shifts and adjust your investment plans accordingly. Continuous learning and staying updated in the fast-evolving crypto market are essential practices for any investor.

Can I adjust my investment goals and risk tolerance over time as they pertain to cryptocurrency?

Yes, it’s not only possible but advisable to adjust your investment goals and risk tolerance over time as they pertain to cryptocurrency. As personal circumstances, market conditions, and life stages change, so should your investment approach. Regularly reviewing your portfolio, financial goals, and risk capacity can ensure that your cryptocurrency investments continue to align with your long-term financial objectives. It’s essential to remain flexible and responsive to the dynamic nature of the cryptocurrency markets.