Cryptocurrency Storage 101: Secure Your Digital Wealth Effortlessly

Diving into digital cash? You’ll need to nail how to store cryptocurrency safely for beginners. It’s not just about having it; it’s about keeping it secure. And you, being smart, won’t leave that to chance. Think of your digital coins like precious jewelry. You wouldn’t just leave them on the counter, right? Same goes for your cryptocurrency. I’m here to walk you through the safe and simple way to secure your digital wealth, from picking your first wallet to mastering high-level protection tactics. No jargon, no fluff – just the good stuff to make sure your crypto journey is as safe as it is exciting.

Understanding the Basics of Cryptocurrency Storage

Choosing Your First Crypto Wallet

Newbie Crypto Wallet Setup

Now, let’s talk about setting up your first crypto wallet. This is where you keep your digital cash safe. Think about it like choosing a bank. But here, you are in control! Start by picking the right wallet. Software wallets are great for beginners. They’re apps you can download on your phone or computer. Simple, right? But don’t rush. Make sure it’s from a trusted brand. Keep your wallet secure by adding a strong password. They say not to put all your eggs in one basket. That’s smart. Don’t keep all your crypto in one wallet, either.

Hot Wallet vs. Cold Wallet

Cold Storage for Cryptocurrency

You’ll hear about ‘hot’ and ‘cold’ wallets. Hot wallets are connected to the internet. Cold wallets are not. They’re like cash in your safe. Both have a job, but one’s safer for saving. Cold storage is the best defense for your long-term investments. Hardware wallets are a popular cold storage. They look like USB drives and only connect to your computer when you use them. Other types, like paper wallets, are literally your crypto keys printed on paper. No internet, no online thieves can touch them. Remember, for daily use, hot wallets are fine, but for your big crypto savings, cold storage is where it’s at. Keep learning about best crypto wallets for starters and you’ll keep your digital wealth safe.

Enhancing Security Measures for Your Digital Assets

The Importance of Passphrase Protection

Strong passphrases keep your crypto safe. They are like special keys for your digital treasure. Passphrase protection for crypto is a must.

Backing Up Cryptocurrency Wallets

For safety, always back up your cryptocurrency wallets. Lose your device; keep your coins.

Multi-Layered Security with Two-Factor and Multi-Signature Methods

Adding layers of protection locks up your digital cash tighter. Two-factor authentication for wallets means double checking it’s you. Multi-signature wallets for security need more than one person to say “okay” before money moves. This way, it’s harder for thieves to run away with your stash.

Best Practices for Crypto Storage

Stick to simple rules. Pick a hardware wallet if you can. They’re like safe boxes for your crypto. Keep your software updated. Share your secret keys with no one. Cold storage for cryptocurrency is often best. It’s like putting your gold in a vault: no hackers. Hot wallets are easy but riskier, like leaving your purse at a park.

Learning the ropes of secure digital asset management isn’t as tricky as it sounds. By picking strong passphrases and backing up your wallet, you make a good start. Encryption is your friend, so use it. Record your recovery seed phrases but hide them like a pirate’s map. Trust me, it’s worth the effort.

Be smart and avoid phishing scams in crypto. If an email or message seems fishy, it probably is. Don’t click on strange links. Stay away from promises that sound too good to be true. They usually are. With these basics down, you’re on your way to becoming a true protector of your cryptocurrency fortune.

The Risks and Best Alternatives to Exchange Storage

Why Storing on Exchanges Can Be Risky

Risks of Crypto Exchange Storage

Let’s get real about keeping your crypto safe. Imagine it’s your gold. Would you leave your gold at a friend’s house and only keep a note saying it’s yours? Storing your cryptocurrency on an exchange is kinda like that. It’s risky. You put your trust in them to keep your digital gold locked up tight. But what if they get hacked? Or they shut down without warning? Yep, you guessed it – your crypto could wave goodbye.

Now, you might ask, what can a newbie do to avoid these risks? The short answer: move your crypto to a wallet you control.

Exploring Hardware and Paper Wallet Options

Hardware Wallet Explained

Think of a hardware wallet like a safe for your crypto. It’s a small device you can plug into your computer. But only when you need to move your crypto around. The rest of the time, it sits tight, offline, away from hackers. See, this is what we call cold storage – because it’s not connected to the hot, risky internet.

Hardware wallets are top-notch because they keep your private keys – that’s like the key to your safe – off the net when you’re not using them. These private keys sign off on your transactions, so keeping them secure is a no-brainer. And with a hardware wallet, every time you plug it in, you use a PIN. Double protection!

But hey, there’s more. You get a recovery phrase too. That’s a set of words that lets you recover your crypto if your device gets lost or broken. Remember, hide that phrase like a treasure map. No sharing!

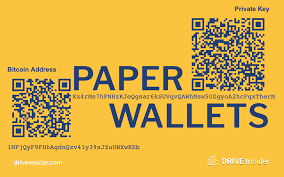

Paper Wallet for Cryptocurrency

Now, a paper wallet is another cold storage kind of thing. It’s simple. You just print your public and private keys on… you guessed it, paper. Then, you store that paper in a safe place. No digital footprint, no hacking worries. Just you and that sheet of good old paper.

But be careful, paper can get damaged, lost, or even stolen. So, it’s not foolproof. It’s super important to make copies and keep them in different safe spots. Not just under your bed.

Alright, so where does all this leave us? When it comes to beginner guide to crypto security, avoid keeping all your digital wealth on an exchange. Go for a hardware wallet for high security or a paper wallet for a low-tech option. Both give you control and peace of mind. That’s what it’s all about – being your own digital wealth guardian. Always stay sharp and keep learning more crypto storage safety tips. After all, it’s your crypto, your future.

Advanced Strategies to Safeguard Your Cryptocurrency

Navigating Digital Threats: Encryption and Phishing Scams

Avoiding Phishing Scams in Crypto

Protecting your cryptocurrency investments starts with you. Biggest threat? Phishing scams. They trick you into giving away your data. Always check for odd URLs or requests. A legit company will never ask for your key over email or text. It’s a scam if they do.

Let’s get real about encryption for crypto safety. Imagine a secret code locking your crypto away. That’s encryption. Nobody can peek at your money without the code. Keeping your crypto under lock and key matters, and encryption does just that.

Secure Backup and Recovery Solutions

Recovery Seed Phrases

Have you heard of a recovery seed phrase? It’s like a magic spell to bring back lost crypto. Write down your unique phrase. Then, hide it like treasure. Lose your wallet? No sweat. This phrase is your comeback. No phrase, no fortune. Guard it well.

Air-Gapped Storage Solutions

Now, an air-gapped storage solution may sound fancy, but it’s just a way to store your coins with no net. Like keeping something in a safe, not your sock drawer. Think offline. Hackers can’t touch anything that’s not connected. So, store coins away from the net – it’s safer.

When you choose to store your digital wealth, you must be smart and alert. Would you leave your house keys on a park bench? No way! Then why risk your crypto with sloppy storage? Use these tips and sleep tight, knowing your digital gold is tucked in right.

In this blog, we walked through the safe-keeping of digital money. From picking out your very first wallet to understanding hot and cold storage, we’ve got you covered. We talked about why strong passphrases and backups are key, and how two-factor and multi-signature methods keep your coins safe.

We also looked at the dangers of keeping your money on an exchange and showed you better choices, like hardware and paper wallets. Lastly, we explored ways to fight off online scams and the smartest ways to back up and recover your funds if trouble hits.

Here’s the deal: protecting your cryptocurrency is a must. Use the tips and tricks shared here to defend your digital treasure. Stay safe, be smart, and happy trading!

Q&A :

What are the best practices for storing cryptocurrency securely as a beginner?

Storing cryptocurrency safely involves a few key practices that even beginners should follow. Firstly, using hardware wallets, also known as cold storage, is considered one of the safest methods, since they store the cryptocurrency offline, away from potential online hackers. Beginners should also use strong, unique passwords and consider multi-factor authentication for any online wallets or related accounts. It’s also recommended to keep a backup of all critical information in a secure location.

What types of wallets are available for safely storing cryptocurrency?

There are several types of wallets that you can use to store your cryptocurrency securely:

- Hardware Wallets: These are physical devices that store your cryptocurrency offline.

- Software Wallets: These are applications that you can download to your computer or phone, and they can be either hot wallets (connected to the internet) or cold wallets (offline storage solutions).

- Paper Wallets: Essentially physical printouts of your public and private keys that can be stored in a safe place.

- Web Wallets: Online wallets provided by exchange platforms, which are convenient but generally less secure than other options.

Each type has its trade-offs between security and convenience, so it’s important to choose the one that best fits your needs.

How can a beginner ensure their cryptocurrency is safe even if they use online wallets?

Beginners can enhance the security of their online wallets by using strong and unique passwords for their accounts, enabling multi-factor authentication, and being wary of phishing scams. It’s crucial to regularly update software, use trusted networks, and never share private keys or seed phrases with anyone. Some online wallet services offer additional security features, such as email or phone verification or the ability to freeze assets if suspicious activity is detected, which beginners should take advantage of.

Is it necessary for beginners to use multi-factor authentication for their cryptocurrency wallets?

Yes, it is highly advisable for beginners to use multi-factor authentication (MFA) for an extra layer of security. MFA requires more than one method of verification to access your wallet, which significantly reduces the risk of unauthorized access. This typically involves something you know (a password), something you have (a mobile device), and something you are (biometric verification).

Can beginners use cloud storage to back up their cryptocurrency wallet information?

While using cloud storage can be convenient for backing up wallet information and seed phrases, it’s not the most secure method, as cloud services can be hacked. As a beginner, it’s better to keep backups on physical storage devices like USB drives that are encrypted and kept in a secure place, or consider using a steel wallet for storing backup phrases. If cloud storage must be used, ensure that files are encrypted and the account is protected with a strong password and multi-factor authentication.