Managing risk when margin trading cryptocurrencies can feel like taming a wild beast. It’s a high-stakes game where fortunes flip in minutes. You’ve heard the stories—the major wins and the crushing losses. But where do they leave you? Hovering over that ‘Buy’ button, there’s a tug-of-war in your mind. The thrill of potential profit battles the fear of a plummeting portfolio.

I’ve been there, and I’ve felt that adrenaline rush. But take it from me, going in blind is a gamble you don’t want to make. In this guide, I’ll lift the curtain on the strategies that savvy traders use to keep risks at bay. Because here’s the secret: it’s not about avoiding risks—it’s about managing them with precision. Let’s dive in and equip you with the armor you need to enter the arena of margin trading with confidence.

Understanding the Basics of Margin Trading in Cryptocurrency

Defining Margin Trading and Its Importance

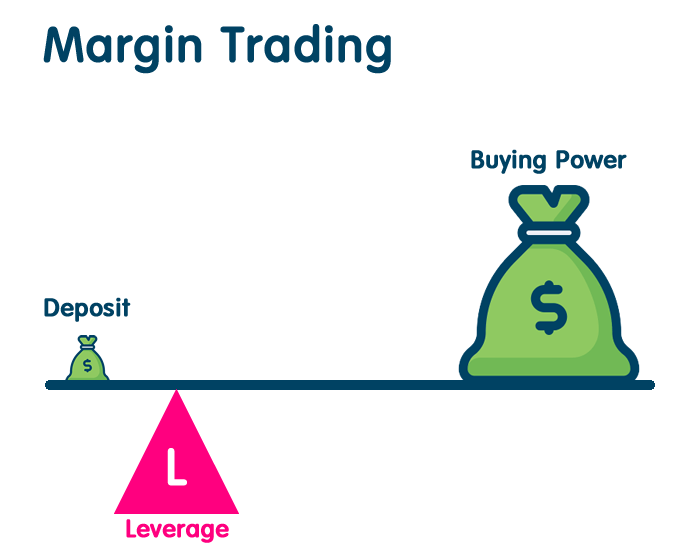

Let’s talk about margin trading. It’s like a loan for buying more crypto. You use a bit of your money, and borrow the rest. This lets you buy more than you could alone. It’s important because it can help you make more money. But it can also lead to big losses. So, when you margin trade, you must be careful.

Recognizing the Implications of Leverage in Crypto Trading

Leverage is a key part of margin trading. It means using borrowed money to trade. Let’s say you have $100 and use 5x leverage. Now, you can trade with $500 instead of your $100. That’s leverage in action. But it’s risky. A small drop in price can cause big losses. And you could get a margin call, where you must add more money fast. This is why managing risk is super important when you trade on margin.

Now, let’s dive deeper into these concepts.

Margin trading in crypto is exciting but tricky. To start, you need something called an initial margin. This is your money that you put down. Then, there’s the maintenance margin. This is the minimum amount you need to keep your trade open. It’s like a safety buffer.

Imagine you’re at a fair, and there’s a high-stakes game with bigger prizes. That’s like margin trading. You put down a little money, hoping to win big. But, if the game stops and you haven’t won enough, you lose your stake. Using leverage can make prizes bigger, yet the risks grow too.

Many crypto platforms offer tools like stop-loss orders. These are like your friend watching your game at the fair. If things go wrong, your friend pulls you out. That’s your stop-loss. It can help prevent huge losses.

Now, imagine you’re wearing a weighted backpack–that’s your leverage. The more weight, the harder it gets. If you don’t manage your load, you might fall. That’s like trading with too much leverage and facing a price drop in crypto.

Remember to balance your trades. Don’t put all your money in one place. This way, if one crypto falls, you still have others to fall back on. It’s all about control. Like having the right gear for the fair game, you need the right tools for trading.

You should also check prices regularly. This helps you know when to stop a trade to save money. And always learn from others. See how the winners play the fair game. Apply their tricks to trading with leverage.

In short, margin trading is your ticket to bigger chances to earn in crypto. Yet, it can also mean bigger risks. Smart traders control their risks. They don’t let the excitement take over. They play it smart and safe, so they can keep playing the game.

Implementing Key Risk Control Strategies

Setting Safe Leverage Levels and Preventing Margin Calls

Leverage in crypto trading is like a double-edged sword. It can boost your profits but also increase losses. Staying safe means choosing the right leverage level. How much should you use? Start with low leverage to keep risks in check. Begin with maybe 2x or 3x before jumping to higher amounts.

Safe leverage levels depend on your trading style and risk appetite. A conservative trader might stick to low leverage; others might go higher. Remember, high leverage can lead to margin calls. This happens when your account balance falls below a specific level, and the exchange asks for more funds to keep your trade open. Avoid margin calls by using safe leverage and keeping a close eye on your balance.

Always start with less and increase slowly as you sharpen your skills. Watch the market closely. If things go south, you may need to add funds quickly. To prevent a margin call, have a plan and stay prepared.

Crafting a Risk Assessment and Stop-Loss Orders Plan

Let’s talk stop-loss orders. These are your best friend in managing cryptocurrency exposure. They automatically sell your crypto at a set price to avoid bigger losses.

When it comes to risk assessment tools, a stop-loss is easy and powerful. How does it work? Choose a price below your buy-in. If prices drop to this level, the order kicks in to sell. This cuts your losses and keeps your funds safer.

Risk assessment means understanding liquidation risks too. This is when your trade is closed because there wasn’t enough margin to cover potential losses. A determined stop-loss can keep you from getting to this point. Position sizing in crypto plays a role here too. Don’t put all your money in one place. Break it up into smaller amounts across various trades.

Volatility management is key when trading on margin. The market can swing wildly. Solid stop-loss strategies help you ride out the storms. They let you set limits on how much you’re willing to lose.

Some traders forget their stop-losses and face big losses. Make it a habit to set stop-loss orders on each trade. And stick to them. They should be part of every risk control strategy.

Managing risk is a big part of trading on margin. It keeps you steady on the unpredictable crypto seas. Use these tools and tactics to navigate safely. Trade with eyes wide open and a keen eye on your balance. Doing so will shore up your chances of positive returns while steering clear of the rocks.

Developing a Robust Financial Toolkit for Crypto Traders

Strategies for Optimal Position Sizing in Crypto

In crypto, how much you trade matters a lot. Big trades mean big risk. They can also mean big wins. It’s like playing a video game. If you bet all your coins on one level, you could lose them all. So we make smart bets instead.

For position sizing, use the “percent rule.” Only risk a small part of your money on any trade. Many traders use the one to two percent rule. This keeps you safe from big losses. You can stay in the game longer this way.

To do this right, you need to know your whole trading amount. Then figure out what one to two percent of it is. That’s your limit for one trade. Sticking to this keeps you calm, your wallet safe, and lets you trade another day.

For example, if you have a $10,000 trading fund, one percent is $100. That’s your max risk for a single trade. This small step can keep you trading longer and with less worry.

The Importance of Portfolio Diversification and Risk-Reward Ratio

Ever hear “Don’t put all your eggs in one basket”? That’s about diversification. In crypto, it means don’t buy just one kind. Buy different cryptos. Some may go up, some may go down. Overall, you could do better.

You should also think about the risk-reward ratio. It’s a big deal in trading. It’s about how much you might win versus how much you might lose. Let’s make it simple. A ratio of 1:3 means if you risk $1, you aim to win $3.

To set it, first figure out where to put your stop-loss. That’s the point you’re wrong, and you should cut your losses. Then, decide your profit goal. That’s where you’d be happy to take your win and leave.

Let’s say your stop-loss is $50 below your buy price. You then set a profit target $150 above your buy price. This gives you a 1:3 risk-reward ratio. Solid ratios like this can help you keep trading strong.

In short, don’t bet the farm on one trade. Spread your risk. And use a good risk-reward plan. By doing these, you’ll trade smarter and safer. You can keep your head clear and your trades sharp.

Remember, trading on margin means borrowing money. It can boost your profit, but also your loss. Stay wise. Use stop-loss orders. Size your positions well. Diversify your portfolio. Keep a good risk-reward ratio. This financial toolkit can help you manage the rollercoaster of crypto trading.

Navigating through Advanced Trading Concepts and Compliance

Understanding Liquidation Risks and Margin Requirements

When you’re trading on margin, getting liquidated means your trade has tanked and the exchange takes your money. It’s like getting your toy taken away because you’re being too risky. To stay safe, know the rules—the margin requirements—like how much money you need to put down and keep in your account. If you goof and drop below this, you face a margin call, where the exchange asks for more money to keep the trade open. Think of it as being asked to refill your glass when it’s almost empty.

How do you avoid this mess? First, play it smart with safe leverage levels. Leverage is borrowing money to trade bigger; more isn’t always better. Use risk assessment tools, like calculators that help you not bet the farm. Also, be your own strict boss with setting profit targets and knowing the liquidation price, so you don’t lose more than you can stomach.

Always have an escape plan—stop-loss orders. These are like setting an alarm to leave a party before it gets out of control. You decide how much you can lose, set that price, and if the trade hits it, you’re out. No staying until you’re down to your last dime.

Balancing Trade Psychology with Strict Risk Management Systems

Trading on margin can mess with your head. It’s thrilling to see numbers go up, but it’s scary when they dive. Keep your cool by having rules to trade by, like not borrowing for crypto margin more than you can pay back and remembering it’s not just fun and games. Use position sizing right; it’s like deciding how many slices of pizza you can eat without feeling sick.

And hey, don’t put all your eggs in one crypto basket. Spread them out—portfolio diversification—so if one goes bad, you’re not toast. Matching risks with rewards means figuring out if the chance of winning is worth the risk. Don’t gamble with your lunch money for a chance to buy a sports car.

Stick to the plan and don’t let your heart rule your trades. Margin interest rates can eat up your cash fast, so watch that balance like a hawk. If you’re too wild, like betting on every horse, you could face a leverage cap, where you can’t borrow much. It’s for your own good, stopping you before you go over the cliff.

Trades get scary fast, and a good trader knows when to hold ’em and when to fold ’em. Use hedging strategies; kind of like wearing pads in football, they help cushion you if you fall. Also, keep learning, be it cross margin vs isolated margin (kind of like team sports versus solo sports), or other big trading words. Stay sharp, stay safe, and most of all, play by the rules so you’re still in the game tomorrow.

In this post, we dove into the guts of margin trading in crypto. Starting with what it is and why it matters, we saw that using leverage can be a game-changer. But like any game, you gotta know the rules to win. We discussed vital risk control moves, like setting the right leverage and using stop-loss orders.

Next, we kitted out your financial toolbox. We unpacked smart moves like sizing your trades just right and mixing up your investments. Remember, don’t put all your eggs in one basket!

Lastly, we tackled the big boys: understanding liquidation and sticking to the rules to keep your shirt on your back. The balance of mind and method is key.

To wrap it up, margin trading in crypto is powerful. Yet, with great power comes great responsibility. Be sharp, be smart, and always plan ahead. Trade well, friends!

Q&A :

What is margin trading in cryptocurrencies and how does it involve risk?

Margin trading in the context of cryptocurrency involves borrowing funds to increase a trading position, amplifying both the potential gains and losses. This technique carries significant risk because market volatility can lead to substantial losses, especially if a trader’s position is highly leveraged.

How can traders manage risk when engaging in margin trading with cryptocurrencies?

Traders can manage risk by:

- Employing strict risk management strategies such as setting stop-loss orders.

- Trading with leverage that is within their comfort zone and aligns with their risk tolerance.

- Keeping a close eye on market movements and news that might impact cryptocurrency prices.

- Being cautious not to overextend their positions and managing their overall trading capital wisely.

What are the differences between margin trading cryptocurrencies and traditional assets?

Margin trading cryptocurrencies differs from traditional assets mainly because of the heightened volatility and 24/7 market access. Crypto markets can swing drastically in a short period, which can magnify risks and rewards. Moreover, the relatively unregulated nature of cryptocurrency exchanges can introduce additional risks such as platform security and liquidity issues.

What are some common pitfalls to avoid in crypto margin trading?

Some common pitfalls include:

- Using excessive leverage that can lead to amplified losses.

- Failing to set adequate risk mitigation orders such as stop-losses.

- Not staying updated with crypto market trends and news that could affect prices.

- Mismanaging the portfolio by overconcentrating in high-risk margin trades.

Is it recommended to have prior trading experience before attempting to trade cryptocurrencies on margin?

Yes, it’s highly recommended to have prior trading experience before margin trading cryptocurrencies. Due to the complexity and risks associated with leverage in volatile markets, inexperienced traders may suffer significant losses. A solid understanding of trading principles, technical analysis, and risk management is crucial before engaging in such activities.