Crypto margin trading can lead you to big wins or steep losses. In Understanding the risks of crypto margin trading, you’ve got to know the game well. It’s like walking a tightrope high above the city. One wrong move and down you go. But with the right skills, you can dance across it, thrilling the crowd below. I’m here to guide you across safely. We’ll start with the basics, break down margin accounts, and talk leverage ratios.

From there, we’ll dive headfirst into the risks. Think of leveraged trading risks like a fire—handle it with care, or get burned. I’ll also show you how to keep your skin in the game when the market gets tough. Ready to learn how to manage sharp swings and use the right strategies for any market? Stick with me, and let’s gear up for this financial high-wire act.

The Basics of Crypto Margin Trading

Cryptocurrency margin trading explained

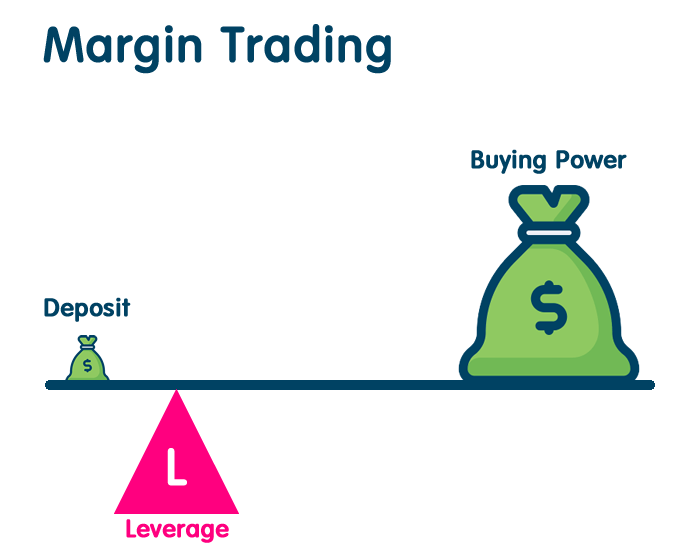

Cryptocurrency margin trading lets you borrow money to trade more. It’s like using a loan to invest. When you put down a small amount, called “margin,” you can trade bigger amounts. If things go well, you can win big. But remember, losses can be bigger too.

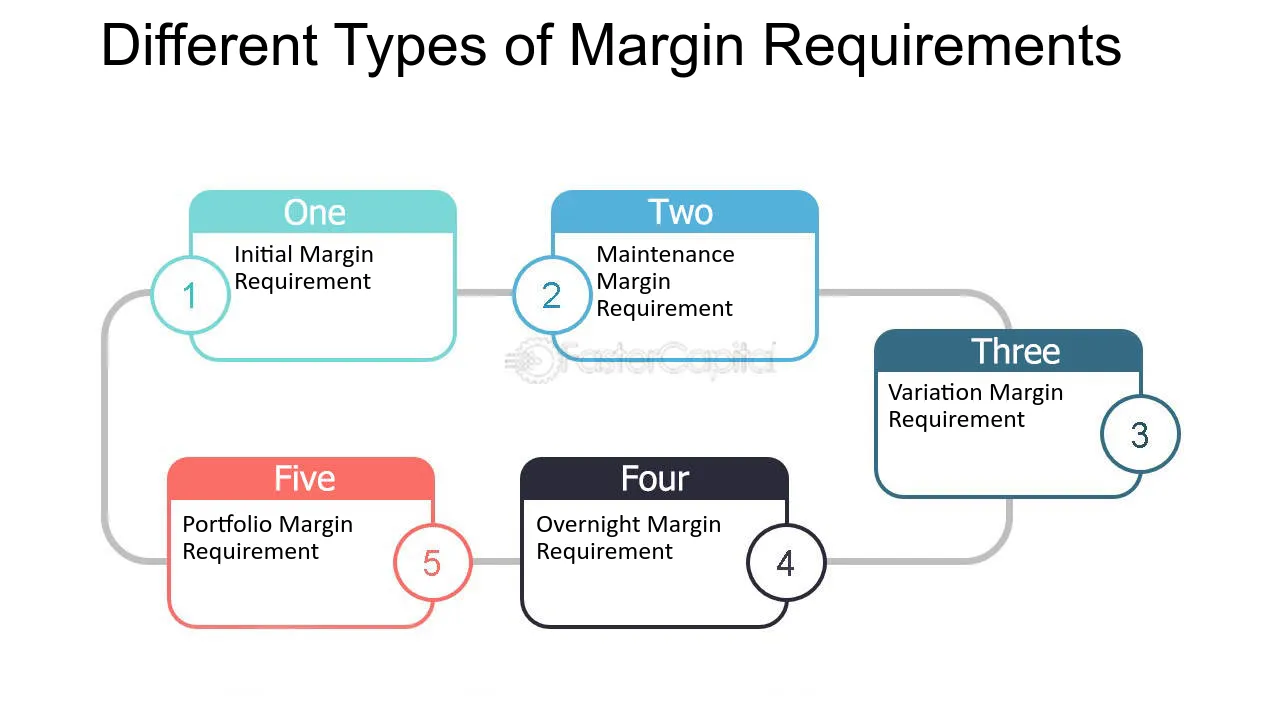

Understanding margin accounts and leverage ratio in crypto

A margin account is what you use to trade on borrowed money. You have to keep a minimum amount, which we call “margin.” It backs up your trades. The leverage ratio shows how much more you’re trading than what you’ve put down. It’s like power lifting with weights—the more weight, the tougher it gets, and more risk.

So why do folks even use leverage in trading? Leverage can boost your buying power, letting you trade more than you could with just your own cash. But just like lifting heavy, it comes with risks. If the price moves the wrong way, losses can come quick and hard. That’s why understanding the game and playing it right is key.

Traders face the dangers of high leverage every day. It’s no joke. When they talk about leverage ranging from 3 to 10 times, they mean business. A high leverage ratio can make for bigger wins but also the risk of losing everything real fast.

If prices fall and reach a certain point, a margin call happens. That’s when the exchange says “Hey, you need to give us more money to keep your trade open.” If you can’t do that, you might face liquidation. That’s when your trade gets closed out, and you lose your margin.

So how can you avoid margin calls? Keep an eye on your trades and don’t overdo it with leverage. You’ll want to have a backup plan, like more money ready if things go south. Also, setting up stop-loss orders can help. These are like brakes on a car—they can stop you from crashing by closing your trade before losses get too big.

Exchanges have rules for liquidation. Know them. These rules say when and how trades are closed if you can’t meet a margin call. It’s there to protect them from losing money. And high-risk crypto investments are always in their sights. No one wants a bad deal, them or you.

The impact of market volatility can’t be ignored. It’s like weather for trading—it changes things up a lot. One day it’s sunny, prices go up; the next day, a storm hits, prices drop. Being ready for these ups and downs is part of the deal in leveraged digital asset trading.

Managing leveraged positions means knowing all this stuff and keeping it in mind. You make a trade plan, decide how much risk you’re willing to take, and stay sharp. It’s not easy, but folks do find ways to win in this market.

All in all, trading with leverage is a big deal in crypto. It’s got ups and downs and can be a risky ride. But with the right know-how and a cool head, you can keep your trades on track and play it safe.

Recognizing the Risks in Leveraged Crypto Investing

Leverage trading risks and the dangers of high leverage

In crypto trading, leverage can lead to big wins or big losses. High leverage means using a small amount of money to control a big trade. This can boost gains but also boost risks. The dangers are real. If prices move against you, losses can pile up fast. Let’s say you choose a high leverage ratio like 10x. This means a tiny 10% drop can wipe out your trade. Ouch! That hurts.

But here’s the good news: you can trade smarter. Start with low leverage and learn how it works. Get good at reading the market. Then, as you get more experience, you might try a little more leverage. Just don’t go overboard. We want smart trades, not risky bets.

Liquidation in crypto trading and margin call in digital currency

Now, let’s talk liquidation and margin calls in digital currency trading. When you trade on margin, you’re borrowing money to trade more than what you have. If your trade starts losing money, the exchange will want that borrowed money back. This is a margin call.

When a margin call happens, you need to add more money or your position gets closed by the exchange. This is liquidation. It’s like a safety net that stops losses before they get too big. This keeps your losses limited to what you can handle. It’s not fun, but it’s an important part of managing risks.

So, be careful with trades on margin. Always watch your trades and have a plan for when things might go south. Use tools like stop-loss orders to protect your money. Knowing how a margin call works can save you from some serious headaches.

Leveraged crypto investing is like a rollercoaster. It has thrilling highs and scary lows. But if you know the risks and how to handle them, you can enjoy the ride safely. Remember, start slow, keep learning, and trade with a clear head. Stay sharp out there!

Managing Leveraged Positions for Long-Term Success

Loss management in crypto leveraging through stop-loss orders

When you dive into crypto leveraging, you should know how to set a stop-loss. A stop-loss is a tool that auto-sells your crypto if the price sinks too low. It’s like having a safety net in case things go wrong. They help you stop your losses from getting out of hand. Don’t let the thrill of potential wins make you forget the real risk of losing.

With crypto’s wild price rides, a sudden drop can happen any time. If you’re not ready, it can wipe out your investment fast. Imagine you’ve got money on a horse that falls mid-race; you’d want to have some protection, right? That’s what a stop-loss does. It cuts your losses quickly.

Mitigating losses in margin trading by maintaining adequate collateral

Now, let’s talk about keeping enough money in the account, or collateral. In crypto margin trading, collateral is key. It’s like the security deposit for the money you borrow to trade more than you have. If your trades go bad, your collateral covers some of the loss. So, keeping it stocked is super important.

Exchanges check if you can cover your bets. They have rules on how much you need to keep in your account. It’s vital to know these rules well. Think of it like this: when you’re climbing a cliff with a safety rope, you make sure your rope can hold, right? Collateral is your safety rope in the risky climb of crypto trading.

If your collateral gets low, you might get a margin call. This means you must add more money or sell some of your assets. It’s like getting a call that you’re running out of fuel in your car. You must refill or you’ll stall. Knowing how much to keep, and when to top it off, stops a total crash of your trades.

By using stop-loss orders and keeping strong collateral, you can limit the bad turns. Sure, crypto’s like a roller coaster, but with the right tools, you can make sure it doesn’t toss you off. Keep it steady and smart, and you’ll have a better chance to win in the long game of crypto leveraging.

Leveraging Strategies for Different Market Conditions

Leveraged trading strategies during high market volatility

When markets go wild, crypto trading can feel like a rollercoaster. You buy with money borrowed, thinking prices will rocket. But if they plunge instead, you’re in for a tough ride. The key is knowing when to play it safe and when to take a chance. If the market’s shaky, small moves are smart. Going all-in could wipe you out if things turn sour.

Let’s get real: crypto can swing high or low in no time. If you bet big with borrowed cash and lose, guess who comes knocking? It’s the margin call, where you must pay up or your investment gets sold off to cover the loss. You can avoid this by not biting off more than you can chew. Keep your leverage low, meaning don’t borrow too much. This way, big swings won’t knock you out of the game.

Preparing for sharp price movements with robust risk assessment

Sharp price moves are like crypto’s bread and butter. But don’t get sliced up by sudden drops. First, make sure you understand how much you owe. It’s easy to get caught up in big win dreams. But if those turns to dust, you should know what you are on the hook for.

Here’s the scoop: setting a stop-loss order can save your skin. It’s like telling your exchange, “Hey, if my investment goes below this price, sell it before I dive into deep loss.” This way, if prices crash and burn, you’re out before things get too hot to handle.

Also, have some cash or other coins ready to back up your trades. This helps keep you in play, even if things get rocky. It’s like having a secret stash; when others panic, you’re cool as a cucumber. But remember, even this won’t help if you’ve gone too far with borrowing. Keep your debt less than what you’re holding, and you stand a better chance to sail through rough waters.

Think of it like this: better safe than sorry. If you’re ready for ups and downs, you can stay afloat when others sink. It’s all about balance and not getting carried away when the market whispers sweet nothings. Stick to your plan, watch the market, and don’t let dreams of quick riches steer you into stormy seas.

We’ve covered the key points of crypto margin trading, from the basics to managing risks for long-term success. Always remember, while leverage can boost your gains, it also amplifies your losses. Keep an eye on the market, use stop-loss orders, and always have enough collateral. By understanding leverage ratios and preparing for market swings, you’ll be equipped to navigate the complex world of crypto with confidence. Trade smart!

Q&A :

What are the main risks associated with crypto margin trading?

Margin trading in the crypto market amplifies both potential profits and potential losses, introducing several risks. One of the primary risks is the volatility of the cryptocurrency market, which can lead to rapid and significant margin calls or liquidations. Moreover, traders may face the possibility of losing more than their initial investment due to leverage, and interest fees can accrue on borrowed funds, adding financial strain. Lastly, regulatory uncertainty surrounding cryptocurrencies can affect market stability, increasing the risk for margin traders.

How does leverage in crypto margin trading increase risk exposure?

Crypto margin trading allows traders to borrow funds to increase their trading position beyond what their own capital would allow — this is known as leverage. While leverage can magnify gains if a trade goes in your favor, it also exponentially increases your exposure to losses if the market moves against your position. A small price movement can result in a significant loss, potentially exceeding the trader’s initial investment, making it critical for traders to fully understand the impact of leverage and to use risk management strategies.

Can I lose more than my initial investment in crypto margin trading?

Yes, it is possible to lose more than your initial investment when involved in crypto margin trading. Because you are trading with borrowed funds, if the market moves against your position, you are liable not only for the initial capital but also for the additional funds that were loaned to you. If your account balance falls below the maintenance margin requirement, you will face a margin call, prompting you to add more funds or risk having your position liquidated at a loss which might exceed your starting investment.

What safety measures can I take to mitigate the risks of crypto margin trading?

To mitigate the risks of crypto margin trading, traders should employ prudent risk management strategies. These include setting stop-loss orders to limit potential losses, using only a portion of your total capital for margin trades to preserve your investment, monitoring positions closely due to market volatility, and staying informed on market trends and news that could impact asset prices. Additionally, starting with lower leverage can reduce the risk until you gain more experience in the dynamics of margin trading.

How can market volatility specifically impact crypto margin traders?

Market volatility is of particular significance to crypto margin traders because it can lead to swift, substantial changes in asset prices. In margin trading, even minor price fluctuations can get magnified due to leverage, potentially triggering margin calls or forced liquidations if the trader’s equity drops below required levels. In highly volatile conditions, it becomes challenging to exit positions without incurring considerable losses, thereby increasing the danger of amplified financial damage in a short timeframe.