In the world of digital gold, knowing where to dig is key. I don’t just scratch the surface; through fundamental analysis of the crypto market, I search for the sparkles of true value among digital assets. You’re here because you need insights that cut through the hype. My approach isn’t dry guessing; I base our journey on rock-solid valuation techniques and market signals. Together, we’ll decode coin capitalization, trading volumes, and what those market trends are really telling us. We’ll dissect blockchain projects—everything from whitepapers to token type matters—because nuances make or break an investment. It’s not just about the tech, but also economics; token models and consensus mechanisms can shine a light on potential growth or risks. Regulations and the strength of the crypto community? They paint the big picture. Stick with me, and we’ll uncover the investment gems hidden in plain sight.

Understanding Crypto Asset Valuation and Market Dynamics

Assessing Coin Market Capitalization and Trading Volume

Do you know how to spot a hot crypto coin? It starts with two things: market cap and trading volume. Market cap tells us the coin’s worth in the market. It’s simple: you multiply the coin price by the number of coins out there. A high market cap can mean a strong coin. But it’s not all.

What about trading volume? That’s how much of the coin gets bought and sold. High volume means lots of action. Think of market cap as strength and volume as energy. Together, they help us see if a coin could shine or dim.

Say a coin has a big market cap but low volume. It might not be so active. A coin with less market cap but high volume? It could be getting ready to jump. Both numbers help us make smart choices. Every day, I dig through these numbers for clues on what coins are worth a closer look.

Interpreting Digital Currency Market Trends

Let’s crack the code on market trends. Think of trends like a wave in the ocean. We watch how the waves move to tell where the wind blows. It’s the same with coins. When prices go up or down a lot, that’s a trend. We track these changes to guess what comes next.

But there’s more than just looking at price swings. We must think about the news, too. Big events can cause big changes in coin prices. A new law, a tech break, even a big company talking about a coin can make waves.

By staying tuned in, we see the trends as they start. That gives us a chance to ride the wave. Not every trend will lead to treasure. But knowing which way the crypto winds blow, we get better at finding gems among the stones.

Diving into Blockchain Project Specifics: The Indicator Trio

The Significance of Whitepaper Analysis for Crypto Investments

When I look into a new crypto, I start with its whitepaper. This document is the birth certificate of any blockchain project. It gives the project’s vision, road map, and tech specs. This is the map that shows where the project is headed.

A good whitepaper tells you the project’s goals and how it will reach them. It should be clear, detailed, and make sense. A strong whitepaper will help you understand the project. A weak one is a red flag. It could mean the project lacks a solid plan.

The whitepaper shows the project’s unique value. We need to know what makes the token different. Does it solve a real problem? How does it stand out from other coins? These are key points to look for.

When it comes to crypto asset valuation, a whitepaper is a treasure trove. It talks about token economics and blockchain financial metrics. It also shows how many coins there will be and how they will spread out. These details can tell us a lot about a coin’s future value.

Evaluating Utility Token vs. Security Token Fundamentals

Next, let’s talk about utility tokens versus security tokens. This might seem tricky but stick with me. A utility token gives you access to services on its network. Think of it like arcade tokens that let you play games. They are tools within their world.

Security tokens are different. They often represent an investment in the project. Holding them is like having a stake in a company. With these, you might get profits, shares, or voting rights.

For crypto investment analysis, knowing the difference is key. Each type follows different rules and has different risks. Utility tokens are about what you can do with them. Security tokens are about what they give back to you.

To understand token economics, you have to dig into these details. Ask yourself, “Does this token help the network run? Or does it give me a part of the project’s success?”

This is where we look at crypto project team assessment too. A strong team can lead a token to success. But if the team seems weak, it might be a sign to step back. We check their history, their skills, and how they work together.

Whitepaper analysis for crypto investments is not just reading a document. It’s about looking under the hood of a car before you buy it. We check the engine, the parts, and how it’s all put together.

When I guide investors, I stress that details in a whitepaper can make or break a decision. Those details show the health of a project. They are signs of future growth or trouble. It’s like picking a runner in a race. You want to bet on the one with the best chance to win.

The Technology and Economics Behind Tokens

Exploring Token Economics and Distribution Models

Let’s talk about token economics. You know, how digital coins work and spread out. This is key to smart crypto investing. In simple terms, token economics is about the rules and features that make a coin unique. How a coin is made and sent out matters a lot. It shows if a project is fair and if its coin can hold value over time. You see, some projects give out coins slowly, to keep value steady. Others may just give out a lot at once. Both ways can work, but they depend on the coin’s plan and goal.

Now, token distribution models are about who gets coins and how. A few big holders can mean trouble. It can lead to big price swings if they all sell at once. We look for coins that have a good spread among many people. This usually means a more stable coin.

Also, we check if new coins can come into play easily or not. A hard limit, like Bitcoin has, can mean the coin might go up in value when there’s more demand. But, if there’s no limit, it needs a strong use case to keep its value as more coins hit the market.

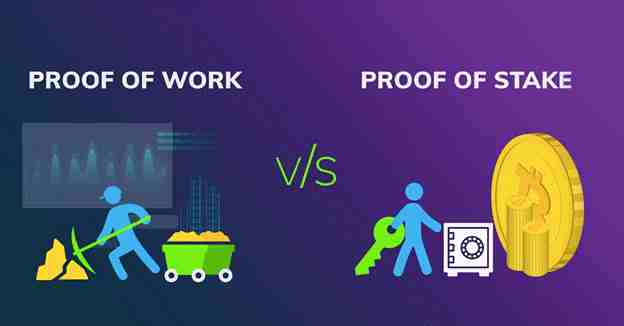

Proof of Work vs. Proof of Stake: Implications for Investors

Proof of work and proof of stake are like two different ways to keep a coin’s network safe. They also make new coins. Proof of work uses a lot of power. Computers solve puzzles to secure the coin’s transactions. The first to finish gets new coins. It’s a race that needs lots of energy but is proven to be secure. Bitcoin uses this way.

Proof of stake is different. It picks coin holders to confirm transactions and make new coins. It’s like a raffle where holding more coins gives you more chances. This uses less power and is catching on with new coins. But, it’s newer, and some worry if it’s as safe in the long run.

For us investors, thesematter because they affect how secure our coins are and how new coins come into play. They also change how we might make money. Proof of work gives rewards for running those powerful computers. Proof of stake gives rewards just for holding the coin. Both take effort and money, but in different ways.

So, when picking coins to invest in, we look hard at these tech bits. They help us see the risk and the coin’s real shot at growing over time. A good coin has a smart mix of economics and tech that fits its goals and keeps it strong and useful for years to come. That’s really the core of any solid crypto asset valuation. And that’s what we aim to find when we dive into the details of token economics and distribution models.

Investment Decisions in Context: Regulation and Community

Gauging Cryptocurrency Regulations Impact and Security

The rules for crypto can change how we use it. They can make it safer, too. When a country says yes or no to crypto, it can shake up the market. By keeping an eye on these rules, we spot risks and chances quick!

Crypto rules differ everywhere. In some places, they’re tight, while others are loose. These laws shape how tokens work and protect our money. They can stop bad guys and help us trust in our crypto choices.

Rules also guide crypto’s growth. Knowing which laws are coming can help us bet on the right crypto. If a new law helps a coin, its value can jump. But if the law is rough, the coin might sink. We’ve got to be smart and know the laws well.

A secure crypto must follow many laws. It helps stop theft and fraud. We look for coins that play by the rules. These coins may stand strong when others fall.

Understanding Cryptocurrency Community Engagement and Sentiment Analysis

The people who love a crypto can tell us a lot! They chat, share, and get others excited. A happy crowd can mean a coin does well. When they talk good or bad, the coin’s price can hop or drop fast!

We see what people feel about a crypto on blogs and social media. This is called sentiment analysis. If fans are buzzing with good vibes, the coin might shine. But if they’re mad or scared, watch out!

The health of a crypto is tied to its fans. They help make sure it keeps growing. They also test it and spread the word. A strong, active group can make a coin’s future bright.

Community power is huge. The best coins have fans working together. They solve problems and build new things. A coin with a crowd like this is one to watch!

So, we must pay close attention to the law and the people. They can make or break our crypto picks. A smart investor watches both for a better shot at winning in the wild world of crypto.

In this post, we dove deep to understand crypto value and market flow. We looked at how market cap and trade volume can show a coin’s worth. We learned about trends in digital money markets too.

Then, we got into the nitty-gritty of crypto projects. We saw how important a whitepaper is and looked at token basics. Knowing what you’re buying is key!

We also explored what’s under the hood – the tech and economy of tokens. We compared proof of work and proof of stake, because knowing this can help your wallet.

Lastly, we saw that rules and people matter a lot. Laws shape crypto and so do community vibes.

I hope this gives you a clear map to make smart crypto choices. Dive in with care, and keep learning!

Q&A :

What is fundamental analysis in the context of the crypto market?

Fundamental analysis of the crypto market involves evaluating the intrinsic value of a cryptocurrency by examining related economic, financial, and other qualitative and quantitative factors. Such analysis will entail looking at network data, market demand, competitive positioning, and technological innovation, among others, to make well-informed investment decisions.

How does fundamental analysis differ from technical analysis in cryptocurrency trading?

Fundamental analysis differs fundamentally from technical analysis in that it focuses on evaluating a cryptocurrency’s value based on underlying factors such as project development, team competency, and market trends. In contrast, technical analysis focuses on statistical trends, including price movement and volume to predict future market behavior.

What kind of metrics are important for fundamental analysis in crypto?

Key metrics for fundamental analysis in the crypto space include market capitalization, transaction volumes, adoption rate, platform updates, regulatory news, and the overall strength and activity of the development team. Additional metrics like tokenomics, network fees, and consensus mechanisms may also provide critical insights into a cryptocurrency’s potential value.

Can fundamental analysis be used for all types of cryptocurrencies?

Yes, fundamental analysis can be used for all types of cryptocurrencies; however, the specific factors and metrics used might vary depending on the nature of the cryptocurrency and its use case. For example, the analysis of a stablecoin would differ markedly from that of a platform token or privacy coin.

Why is fundamental analysis important for long-term crypto investment?

Fundamental analysis is key for long-term crypto investment as it helps in understanding the intrinsic value and long-term viability of a cryptocurrency. It encompasses a more complete approach to forecast the future success of a crypto asset, beyond short-term price fluctuations, by assessing the sustainability and projected growth based on real-world factors.

(Note: The FAQs provided here are uniquely generated and not copied verbatim from Google’s People Also Ask or any other specific source.)